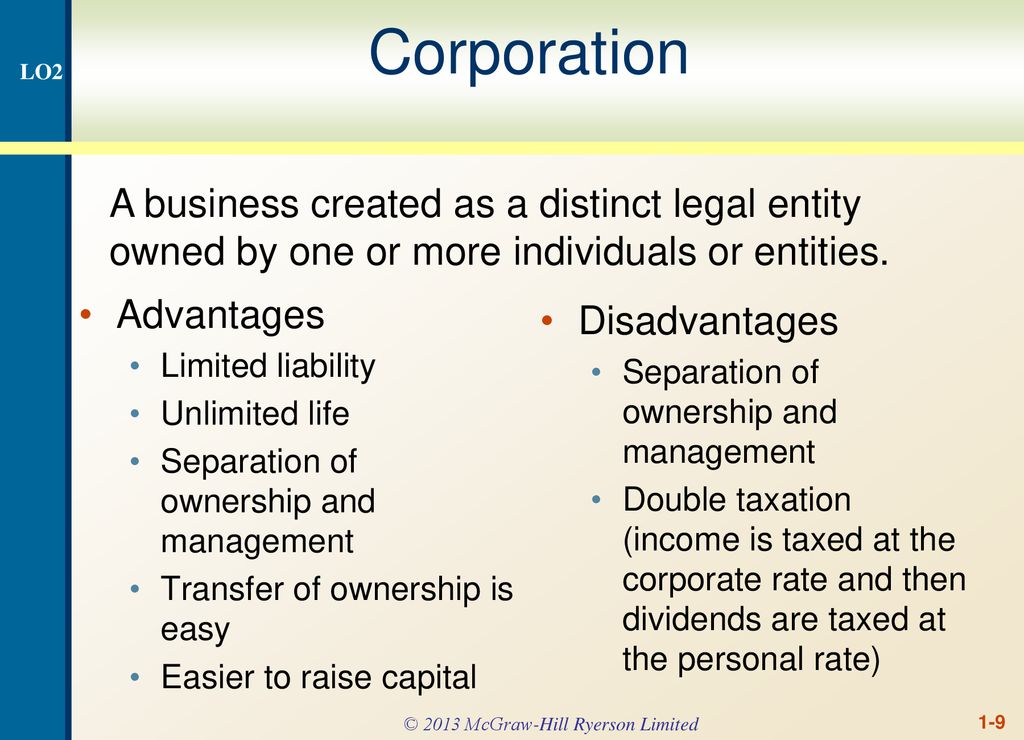

Some countries adopt “tax holidays” that permit newer companies to be exempt from income taxes, or utilize different approaches to taxing the value additive components of production by an entity. As ownership spreads out and shareholders increase, a board of directors is often chosen to make decisions for the entire corporation. The board of directors are also tasked with selecting the management team. One of the difficulties with running a corporation is the dissemination of power and the loss of accountability as control spreads. This lack of accountability can lead to what is known as the “agency problem” which is when management makes decisions based on their self-interest instead of the interest of shareholders. Before discussing the advantages and disadvantages of a corporation, we must first understand what makes up a corporation.

Best Account Payable Books of All Time – Recommended

Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. However, if you are new to business, you should at least consult with a business attorney before attempting to form a corporation on your own. This is different from partnerships where the partners are involved in the management of the partnership. While some partnerships may have partners that do not manage the partnership, most of the partners are still involved in management roles.

Distinct Legal Entity

If certain prerequisites are completed, the company can elect S Corporation status. This option allows the corporation to be taxed in the same way as a partnership. They must also decide how much time and money they will devote to each other ahead of time. Sole owners are legally accountable for all obligations owed to the company and have limitless liability. Companies operating as an incorporated business may find it easier to raise money.

- The only way a corporation ends is if it deliberately ended through liquidation or other means.

- Before discussing the advantages and disadvantages of a corporation, we must first understand what makes up a corporation.

- While this problem has existed for all corporations for a long time, there is no definite solution to it.

Main Types/Forms of Business Organization

Shareholders can easily buy and sell the shares of a corporation in a stock market without the need for prior approval. There are many advantages and disadvantages a disadvantage of the corporate form of organization is of corporations as a general or as compared to other types of businesses. Some of these advantages and disadvantages are discussed below.

The Advantages of the Corporate Form of Business Organization

Before deciding on the type of business to form, it is important to weigh all of the pros and cons of each business structure. Corporations must file Articles of Incorporation with the state they are incorporating in, for which states charge different filing fees. They may also need to file bylaws, which may require the help of an attorney to write.

Advantages and 4 Disadvantages of Corporation You Should Know

For example, if a corporation is sued, the shareholders are not personally responsible for corporate debts or legal obligations — even if the corporation doesn’t have enough money in assets for repayment. Personal liability protection is one of the main reasons businesses choose to incorporate. A partnershipA business formed by two or more individuals or entities.

These disadvantages may apply to both the shareholders and the corporations. Corporations can enter into contracts and guarantees, lend and borrow money, invest funds, buy, own or sell property, and get into legal disputes as a separate entity. This means that a corporation does not need its owners for these things. As discussed above, corporations create limited liability for the shareholders.

The corporate form of organization has many variations around the world. The exact laws and regulations differ from country to country, of course, but the essential features of public ownership and limited liability remain. These firms are often called joint stock companies, public limited companies, or limited liability companies, depending on the specific nature of the firm and the country of origin. Most corporations are taxable entities, and their income is subject to taxation. This “income tax” is problematic as it oftentimes produces double taxation.