You might not put a lot of thought into your abbreviations, and that’s okay. However, there are official abbreviations out there that you might come across, and it would help to know about them. We’ll explain the correct abbreviation for “million” in this article.

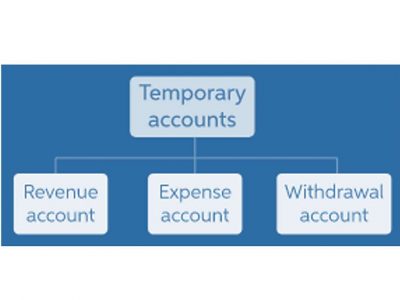

Alternative Notations for MM (Million)

Decoding abbreviations like “M” and “MM” not only enhances communication skills but also boosts confidence in using numbers effectively. With a bit of humor and practical advice, this post will help anyone become more fluent in the language of abbreviations. In various aspects of finance such as budgeting, financial analysis, reporting, and forecasting, the use of MM aids in ensuring accuracy and precision.

- As businesses operate on a global scale, the need for standardized financial terminology becomes paramount.

- Any universal shift would require a coordinated effort from all major institutions simultaneously.

- Led by editor-in-chief, Kimberly Zhang, our editorial staff works hard to make each piece of content is to the highest standards.

- Because the capital letter M is the Roman numeral for a thousand, you may want to use the lowercase letter to avoid confusion.

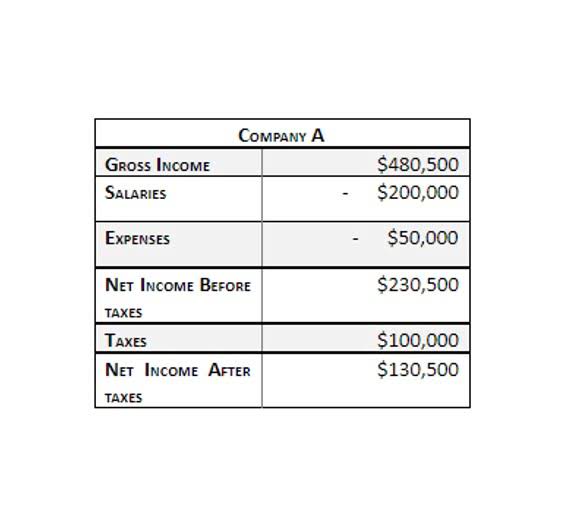

- For instance, if a teacher were discussing a budget, mistaking “MM” for “M” could significantly alter the figures involved.

Conclusion: An Enduring Convention

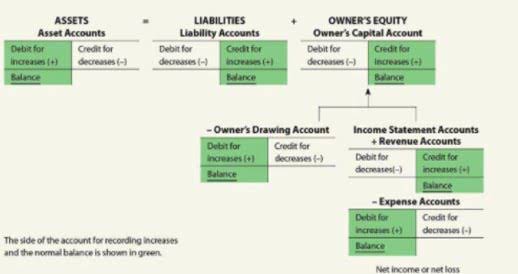

One thing to consider is that when writing about large amounts of money, the words “million” or “billion” are often left out altogether, as are superfluous zeroes. It’s then up to the reader to note the context, with the document stating the place value once at the beginning and not again. As stated above, MM is generally used in business to represent millions since the letter M by itself has historically meant https://www.bookstime.com/ 1,000.

Recent Posts

As an adjective, a million represents something immeasurable, indefinite, or without number. In the English language, “a million” can be a metaphor for a very large number. A million is equivalent to the product of a thousand times a thousand. One million can be written as the number one followed by six zeros—1,000,000. This exemplifies the immense resistance to abandoning shorthand like MM that has existed for centuries. To understand MM, we have to go back CARES Act to the early days of accounting when Roman numerals were used to record ledgers.

How Do You Abbreviate Million Dollars?

In its simplest terms, a million is “one thousand thousand”. The word “million” is most often used in reference to money, but is also frequently used in exaggeration. The word “million” can be paired with the suffix “-aire” to form the word millionaire which indicates an individual with a million or more dollars. The term enables clarity and consistency, reducing the risk of misunderstandings due to different interpretations of number notation. Now that you know several large number abbreviations, you have access to several options you can use in your reports or other forms of writing. You may also find it helpful to review measurement abbreviations for common units.

- Yes, MM is recognized globally in the world of finance and accounting to represent one million.

- In various aspects of finance such as budgeting, financial analysis, reporting, and forecasting, the use of MM aids in ensuring accuracy and precision.

- This is particularly important in scenarios where quick decision-making is required, such as during mergers and acquisitions or when assessing investment opportunities.

- The term “MM” originates from the Roman numeral M, which stands for one thousand.

If you see an abbreviation that is confusing or unclear, please reach out to your local underwriter or branch for clarification, even if you are just asking for a friend. By understanding when and how to use ‘M’ and ‘MM,’ one can communicate numbers effectively and clearly. If ‘MM’ is used in one section, it should be used throughout the document. Using ‘M’ is helpful when detailing significant figures, like total sales or market capitalization. does mm mean million It allows busy stakeholders to grasp important figures quickly without getting lost in zeros.